Yield Not To Temptation

Bonds are usually thought of as the comforting part of an investment portfolio. Low volatility, steady returns, and a sure-fire way to preserve capital. Think again.

The recent globally synchronized rise in the sovereign yield markets, save for the China Dim Sums, has been a result of the process of unraveling central bankers' unprecedented QE experiment. And like any good experimental scientist, you better stand back in case something blows up.

This is the uncertainty we are just beginning to experience. What happens when the mother of all stimulus efforts reverses? Unfortunately for the owners of hyper-expensive concept stocks, the experience so far has been a disaster. Just ask Cathie Woods, whose highly-touted visionary status now lies in tatters. The dangers of relying on a regime of overly easy money and ever-expanding valuations have been brought home in spades. The Fed's hawkish pivot has taken that particular punch-bowl away for good.

The consensus for U.S. Treasuries, has, with blinding speed and conviction, moved to 'price in' as many as 7 rate hikes for the next year and a half. And for their part, central bankers are mostly reluctant to dissuade the now-chastened bondies from their opinions. The pendulum has swung 180 degrees from the Omicron-induced lows of late last year.

But I have learned to be wary of group-think.

What are we to make of the chart below? It depicts the market's evaluation of the future course of inflation expectations. It takes the futures market and turns it into a forecasting tool. The five-year 'forward' markets reveal the price investors are willing to put money to work in the future. Taking that information and comparing it to current 'spot' prices for the same duration security reveals the market-based inflation forecast. It has already peaked and now sits at 2%. I guess some people aren't too worried about systemic inflation.

5YR - 5YR Forward Differential

The second way to look at it inflation forecasting is the shape of the yield curve. it has decidedly flattened since the Fed's game-plan shift to tighter money. The curve shape is also a way to parse the bond market's forecast of future inflation ratings. If the 10's flatten out at 2% with a declining 2s - 10s spread imputes investor's confidence in a 'successful' tightening - one that quells the notion of ever-rising inflation expectations.

10Yr - 2Yr Yield Differential - U.S. Treasuries

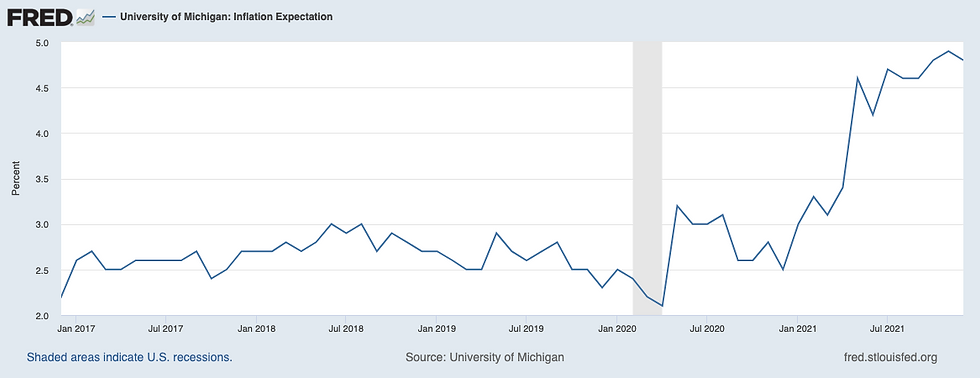

But questions remain as to the 'terminal' rate for the longer end of the yield curve. In a financial market currently in a state of flux, it is impossible to say. Elements of rate forecast variability keep multiplying. Oil prices, and by extention prices at the pump, have been a huge driver of consumer behaviour and expectations. The University of Michigan survey of these expectations is significantly higher than what bond markets are implying. They are more representative of 'current' inflation expectations which haven't been helped by the oil price surge and the impact of supply chain shortages.

University of Michigan Inflation Expectations

But if the Ukraine premium comes out of the oil price, and with the end of winter demand looming, the oil market could pull back sharply. Emanuel Macron's diplomacy efforts are a good start. I have watched with interest the upward march in the U.S. domestic rig count, while at the same time production estimates are rising in the shale patch. Russian saber-rattling is a time-honoured tactic that allows Vladimir Putin to control the geopolitical narrative. He has already achieved his aims of elevating the oil price and the concomitant revenue boost to Russian export surplus coffers. Any further incursion into Ukraine will be counterproductive for Russian energy exports as the Nord Stream 2 project would be threatened and Germany would quickly source more energy from more secure sources such as LNG and renewables.

But siding with bearish bond traders, ganging up on the bond market this week, might not be advisable. Don't forget that volatility often works both ways. The much-ballyhooed 7% inflation print due on Thursday might be a short-term sell-the-news top in ten-year yields. Yes, rates are destined to be higher one year out, but the bid to the U.S. Treasury market comes from a structural shift in the amount of global liquidity which is still massively tilted to a persistent quest for safe yield. Underneath this bond market, there is still massive support for secure safe-haven wealth preservation assets, especially now that the shiny coin trick of the growth stock bubble has dimmed.

China, currently being whitewashed by an Olympic sideshow, is in a self-induced mini-recession in their domestic economy. Their doomed zero-Covid policy layered on top of the complete debacle in their property markets is still an under-appreciated negative for global growth expectations. So far, it has served the higher inflation narrative, as the export markets that have supported the economy have been strong enough to offset the domestic slowdown. The 'shut-down' policies have also elevated concerns over the fragile supply chain. But they must act quickly now to soft-land the domestic economy and provide support for the shell-shocked investors who now realize that they have been victimized by a generational real estate Ponzi scheme. If President Xi doesn't keep throwing money at the problem, he threatens his re-affirmation as "President for Life". All this is 'good' news for U.S. bond markets, especially from a global haven standpoint.

The ECB has engineered a pivot as well. Feeling better as the economies of Continental Europe act better, Mdme. Legard has indicated the potential of rate hikes is now a reality. But the 'sky is falling' nature of repeatedly failed Eurozone rebound play will keep yields there subdued after this week's burst of repricing. I remain in 'show me' mode after this bounce. The 'value trap' monicker in European equities is well earned. In non-domestic equities, I prefer $EMXC - the emerging markets ex-China ETF.

Tricky as all this seems, it's what the market needs. The positive outcomes we gain from restoring the balance between the needs of consumers and savers will ultimately generate stability in credit markets that will be critical for the investment decision-making process. Re-normalizing the bond market, as difficult as it appears, will ultimately prolong the equity cycle and for that, we should welcome the current financial sauasge-making now challenging the confidence of investors.

Bond market fears are driving bearish narratives that to me seem overdone. Yield not to the temptation - to panic out of risk assets.

Risk Model 2/5 - Risk Off

The Copper/Gold ratio chart looks like the EKG of a hummingbird. No wonder the market has such an uncertain feeling about it. Is the Fed tightening into a slowdown? Will the Ukraine standoff escalate, putting a big bid into gold? Is a China hard landing unavoidable? Is the growth stock bubble bursting á la 2001? One week to the next the narrative changes. My advice - step away and wait for a fat pitch. Last week I took a swing at a few falling knives like Shopify and Etherium. They are already sold. I won't be comfortable 'investing' in this market until I see two things: a steepening yield curve and a definitive break-out in the Copper/Gold ratio. The latter could come quickly if the post-Olympic Chinese seasonal re-acceleration begins. The Chinese government bought stocks this morning in an effort to halt the carnage, but that is hardly enough to generate the necessary preconditions for sustainable growth.

Copper/ Gold Ratio

In a market of heightened volatility, I will be in cash more often than not. Even short selling will come in handy for the first time in two years. My trade pick this week is 'short' energy - but with tight stops. My 'long' pick is TLT. Next week it will be different. Get used to it.

Comentarios