Touch and Go

- Bob Decker

- Apr 9, 2024

- 4 min read

Any good pilot will tell you if conditions aren't right to land the plane you reaccelerate and 'go around'.

My wife and I, on our recent trip to Lisbon, experienced just such a situation. Strong gusty crosswinds buffeted our TAP-operated Airbus 330 as we first attempted to land. With a sudden thrust from the engines, our pilot aborted the landing with just 50 ft between us and the ground. A further 10 minutes later, after a circuitous tour of the city, we successfully touched down, albeit with a bit more sweat on our brows.

Financial markets are also attempting to land in similar strong crosswinds. My macro call has been that inflation will be sticky. That was behind my call to sell bonds in January. The U.S. CPI report tomorrow, by all expectations, should show an economy that has yet to successfully land on the hoped-for 2% inflation runway that Captain Powell has forecast. The stronger-than-expected crosswinds of 300k+ employment growth combined with sticky services and shelter costs have prevented him from an easy touchdown. The Fed has had to push out the previously exuberant rate cut expectations, reducing the market's rate cuts from 7 to 2-3. They have 'gone around' relatively speaking.

But it won't change the outcome. This economy will land at some point. But the winds need to die down first.

The factors holding Chair Powell back are well known. Sticky labour supply has kept the bid to the service sector while the lagging measurement of shelter costs is propping up the core CPI. Headline measures will suffer from a sudden surge in gasoline prices, further delaying the drop in consumer inflation expectations. Both these are fixable in the long run but, will delay the onset of the rate-cutting cycle.

So the past few weeks of digestion that I predicted would follow the good news of a stronger-than-expected economy have played themselves out. Tesla has been vilified. The Magnificent Seven are spent force as their momentum has gone off the boil. The copper oil and gold markets have rallied. And the broader participation I expected is evident from the expanding market breadth. Remember when I said, "Banks, thanks"? Despite the AI hype, the XLF has beaten the XLK so far this year, thanks to the drag from AAPL and TSLA.

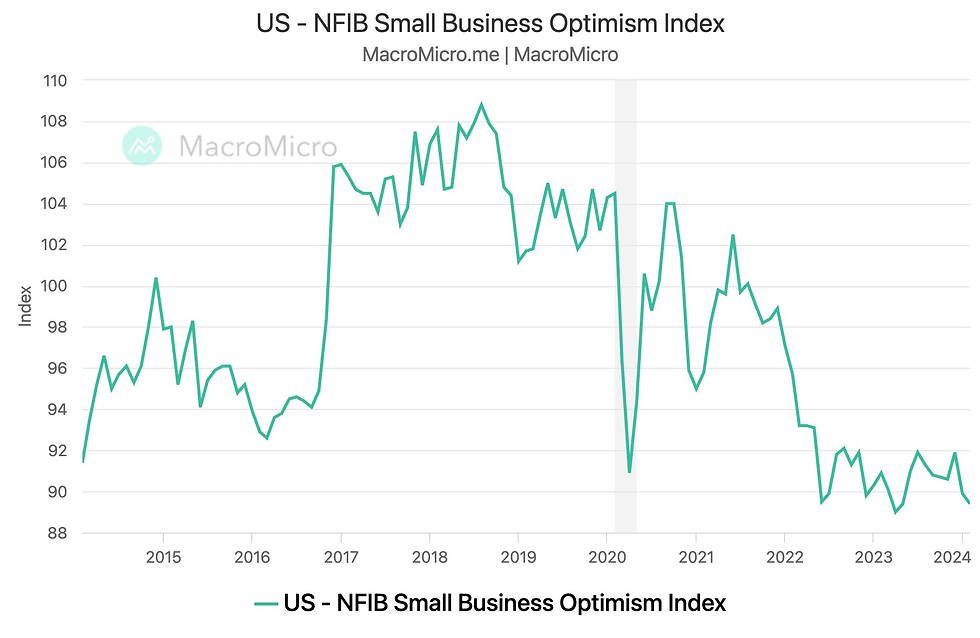

But I think this pause that refreshes could reignite the markets into a classic 'Sell in May and go away' cyclical peak. The rate-cutting motivations generated from a slowing economy should become more dominant as we move forward. The now somewhat tarnished inverted yield curve indicator is still acting like a brake on the economy, despite being offset by the quirk of the locked-in 30-year mortgage structure in place in the U.S. This is at the heart of the much-ballyhooed "U.S. exceptionalism". In Canada, the 6% unemployment rate and weaker GDP can be blamed on the higher rate sensitivity from variable and short-duration mortgage resets. The drop in U.S. small business confidence - a highly rate-sensitive segment of the economy - speaks volumes. It exhibits no recovery from the Covid collapse.

More impactful, a decline in investor confidence should bring more headwinds as the U.S. draws closer to the elections. The election nobody wants is looming ever closer.

Trump's call for import tariffs is a stagflationary bombshell that will diminish investment spending and lead to consumer retrenchment. Biden's policy on China won't be as hardline but is cut from the same protectionist cloth. The bull case for Tesla is supported by a potential China EV import ban that is a plank in both parties' platforms. Additionally, their leading position in battery technology is an increasingly positive intangible for the remaining Musk Maniacs like Cathie Woods. I've covered my short for now but expect to re-enter soon.

Despite the positives generated from the Fed pivot in November, the markets have yet to definitively exhibit a durable change in leadership. Small Cap, Value, and Cyclical stocks have all rallied and may rally further still. But the catch-up trade in these left-for-dead stocks lacks confirmation from any data to support the case for a true reflation of the economy. Small Cap has yet to demonstrate any relative strength improvement (Chart below). Hoped-for rate cut expectations are at work here, not any real credit-driven consumer expansion.

S&P Small Cap vs Large Cap

We have jumped the gun on the Fed leaving markets vulnerable to disappointment. Should that disappointment come from the bond market or a reduction in earnings expectations, is an open question still. Either scenario is possible.

Our pilot, Jerome Powell, has some work left before we are on solid ground.

Risk Model: 2/5 - Risk Off

With the rally in Copper still lagging behind the bounce in Gold, I can't call the bullish reflation we have seen anything more than a catch-up trade motivated by guesswork. It makes no sense to me that copper should lag the gold move if the economy was reaccelerating. I want to believe that China's recent moves to shore up its economy will be successful, but the clumsy execution and harsh tone from Bejing both leave me suspicious that this latest round of pronouncements will lead to much. They are in a debt spiral and demographic bind that is exacerbated by a de-globalization chill that retards trade and export growth. The likes of Indian and Ex-China ASEA need to pick up the slack.

Copper/Gold

We got the Volatility Index bounce I was hoping for but it was feeble when compared to the previous risk-off calls. Could be the effect of a still comforting narrative being pedaled by the Fed. Bullard's comments yesterday exhibited a fair degree of hope-ology that the markets have latched onto, thus truncating the sell-off in risk that had begun post the March month-end window dressing.

The next sell-off should be related to a change in the narrative that has propelled us to this over-bought and FOMO-driven extreme. Hence my sell-in-May conviction.

Comments