Overweight and See

With the definitive topping out of bond yields based on this morning's news and the reflexive bounce in equities, the average investor can be excused for being in a state of confusion. Are lower yields implying impending economic doom? Or is the soft landing dream becoming reality as the bulls want you to believe? The rotation and broadening out of the market are still pending that decision.

We need to wait and see. I know, I know, that is unsatisfyingly vague as a narrative, but sometimes it's all we have. Meantime, we should be overweight certain risk assets. But not all.

This morning's CPI has demonstrated how difficult it is for a definitive prognostication about the future path of the economy and, by extension, the financial markets. Core inflation has surprised to the positive and the Fed is now faced with reversing the hawkish tones that were present in their previous communications. The Dimon bottom for bond prices is firmly intact.

Based on this morning's "All Clear", and "Mission Accomplished" vibe, the markets have anointed the Powell Fed with a job well done. Markets are seeing the bullish soft landing that it has dreamt about for months unfold before their very eyes. All that seems to be missing is a lowering of administrated rates and a normalization of the inverted yield curve - which has deepened its inverted status recently due to the long-end rally.

But should the disinflating economy metastasize into a full-blown recession as a result of a Fed that stays on the brakes well past the point of no return, a recession is still possible. That risk to economically sensitive assets is what I am waiting to see. To truly anoint this rally as a bull market extension phase and not a narrow chase of the past winners, we need a sign from the labour market that it concurs with the 'soft' part of the soft-landing narrative.

We still need some more bad news on the employment side of the dual mandate before the Fed releases its grip. I think we'll get it. The intermarket signals embedded in the most recent rally are not confirming the reinstatement of the bull phase. Breadth is lagging, as large swaths of the market still trail behind the leadership of the large-cap growth stocks. Small caps are still lagging. Economic deceleration is still being reflected in this 'missing link' of equity market performance.

The last time this happened was in late 2021 when the Covid chill in economic performance scared investors away from all but the largest and most well-capitalized firms such as Apple and Amazon. Suspiciously that ended at year-end and the January effect was in full swing as the laggards became leaders. This effect was reversed the next year as the rise in Fed Funds threatened the economy, driving investors into the Magnificent Seven et al. I expect this reversal of leadership to occur again this coming January.

Value vs Growth ETF

And it makes sense. The large, cash-rich quality stocks are sensitive to long rates. The rest of the market is sensitive to short-term rates, which, in turn, are beholding to a Fed still traumatized by how wrong they were about inflation and consequently reluctant to ease policy prematurely. That's why a little more bad news is important to see.

In the meantime, the rally to the year-end is still on. The leadership is obviously "what has worked". Tax loss selling will hold back the laggards. January will be a new broom that sweeps clean and the value trade should recover should the Fed signal any rate relaxation on bad news. Until then, overweight the likes of MSFT, AAPL, TSLA, etc., and see.

Risk Model: 3/5 - Risk On

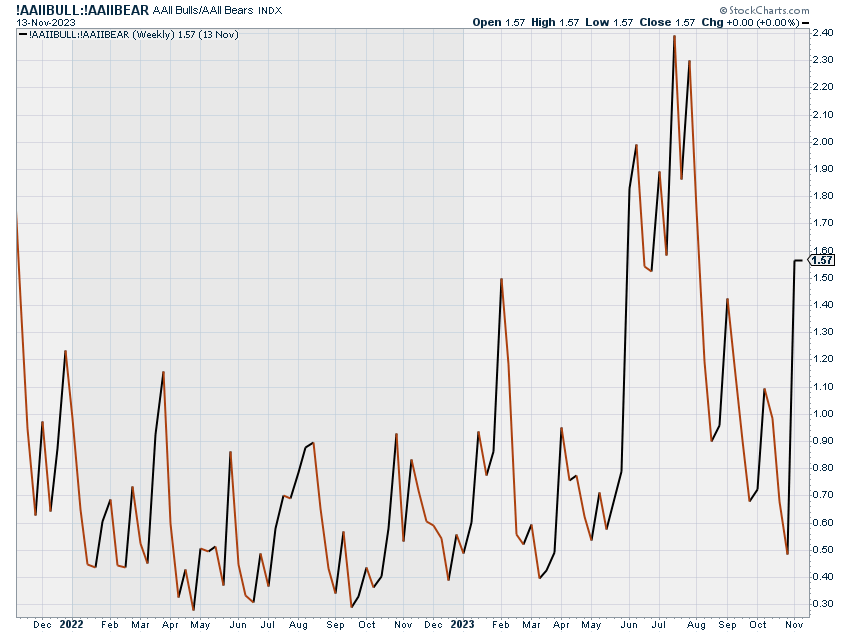

The model has it right this time. The suddenly emboldened "bullish" AAII respondents number is a shocking reversal but I can't fight the tape here. The VXV and 200 DMA are in agreement.

AAII Bull/Bear Ratio

The two flies in the ointment are the overbought RSI and the lagging Copper/Gold ratio But the latter is set to recover now. Any sign of the Fed easing will quickly translate into expectations of a weaker dollar and stronger commodities. That is also something to wait for.

Copper/Gold Ratio

コメント