Cu Later

- Bob Decker

- Apr 30, 2024

- 5 min read

Copper has been on a tear this month, but has anyone noticed? The TV talking head echo chamber is seemingly unaware of the recent spectacular rally as they focus on sexier issues like Elon Musk's net worth, which rose more than the value of BHP's bid for Anglo-American last week alone. Commodities seldom get the attention they deserve in the financial press. When talking about 'the metals market,' CNBC limits the discussion to gold and silver. Maybe if the LME moved to New York, they might notice.

Copper prices rank well down the list of news topics despite their redoubtable economic forecasting credentials. Wall Street never learns. Goldman Sachs tried to promote the secular bull market in 2022, with its highly respected commodity strategist Jeff Currie leading the charge. The collapse in China's real estate market and a hostile Fed put paid to that preemptive rally. Currie has since left Goldman, scooped up by private equity firm Carlyle, where his mistakes can be more easily obscured.

That looks like a reverse indicator buy signal to me. I believe he was right, but early. I pointed out last week that the press has tried to retire 'Dr. Copper'. But, like many of his medical world equivalents, the venerated metals doctor is still working well past his retirement date. My Risk Model's Cu/Au indicator has decisively resolved higher (see below).

And the copper secular bull market isn't waiting for the Fed to cut. It's already here! The long path to $12,000 per tonne ( $5.50/lb) has begun.

The threats that have held back the bull case now look like spent forces. The threat of a recession has been wildly overplayed by the permabears. The Fed has signaled its willingness to support the economy by cutting rates this year. And now, China's highly publicized economic drag on commodities may be close to ending. Their manufacturing export drive has helped mask the negative vibes from the zombie real estate sector. The negative demand effects from housing are being subsumed by factories at full capacity.

Meanwhile, has anyone noticed which country of 1.4 billion people on an 8% GDP heater recently sent a delegation to Chile to look for copper and lithium assets? I'll give you three guesses, but the first two don't count. Hint: their spicy food is a tell.

India's economy is powering ahead, boosted by the confidence of its reform-minded leader, Narendra Modi. A government source was quoted recently saying:

"We are interested in buying assets. We are trying to facilitate private and government-owned companies to acquire assets in other countries as well,” the anonymous source told Reuters."

It sounds a bit like Deng Xiaoping's game plan circa the year 2001.

In past cycles, the bull case for copper demand rested on the more mundane uses in plumbing and household electrical grids. Copper analysts routinely scoured the housing start numbers in the U.S. Not anymore. The electrification of the new economy is now a far bigger influence. Copper demand is increasingly inelastic to the economy, given its structural and public policy tailwinds in the green economy.

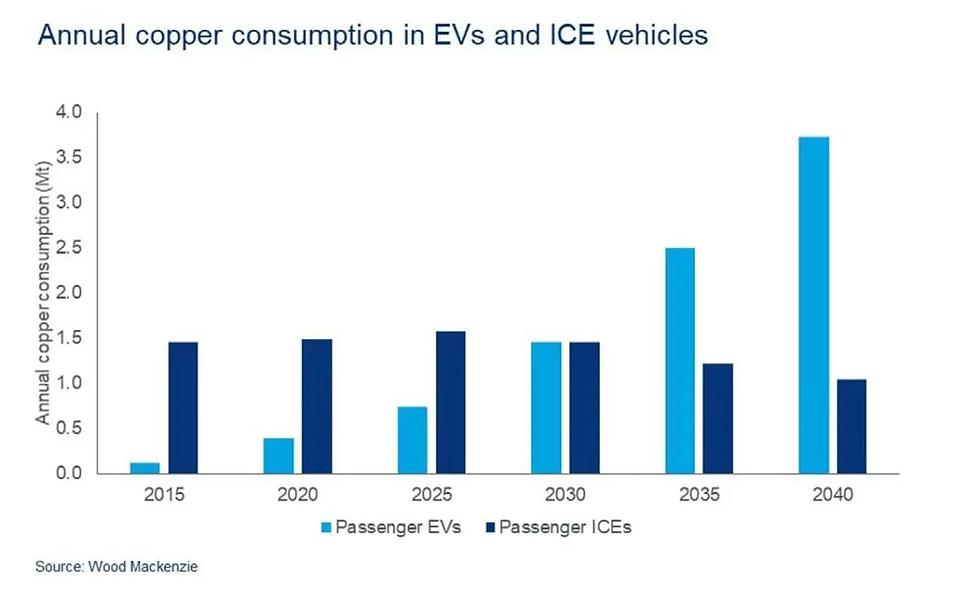

So, the secular case for copper continues to strengthen. IEA estimates that the quantity of copper used for wind and power is 2-3 times that of natgas and nuclear plants. The copper intensity per new EV vehicle unit is also a multiple of the ICE trade-ins they replace.

Can Copper be an AI play?

The AI revolution consumes vast quantities of power for computational infrastructure. A recent Scientific American article claimed that Google's conversion to AI would require the same power supply as the entire country of Ireland.

" ...by 2027, A.I. servers could use between 85 to 134 terawatt hours (TWh) annually. That’s similar to what Argentina, the Netherlands, and Sweden each use in a year, and is about 0.5 percent of the world's current electricity use."

Yes, Copper is a direct play on AI, but the stocks are much less hyped than NVDA. But maybe not for long. The U.S.'s leading copper producer Freeport McMoran, has blown through a 20-year base pattern. In Canada, Teck Corp looks similarly poised to climb. The larger the base, the stronger the case, in my view.

Freeport McMoran

Teck Resources Ltd.

A reality check: the bullish long-run view can be subject to short-term setbacks.

The biggest threat to the bull case is an increasingly possible financial policy accident. This morning's U.S. labour market data showed evidence of a stubbornly inflationary bias. This, is on the heels of three months of "bump on the road" type hot inflation data. Should the Fed, with its backward-looking driving style, succumb to these lagging indicators and hike rates unexpectedly, all short-term bets are off when it comes to commodities. I'm very closely waiting for Powell's comments this week. Any hint of a hawkish tone won't go over well with adherents to my bullish thesis of last week.

I am holding fire this week, waiting for the Fed. The stocks offering exposure to the red metal are short-term overbought and nearing their seasonal peaks. A short digestive phase should follow the recent rally, especially if the Fed's hawkishness molds the narrative. However, the pull-back, should it continue, would be a perfect entry point as the bull market for cyclical assets has only just begun. The sweet spot would be a seasonal low in June that tests the breakout pattern.

After that, I think it's 'Cu later' to sub $4 copper prices.

Risk Model: 3/5 - Risk On

A neutral price construct, RSI 50, reinforces the case for waiting to see what the Fed thinks. The VXV component of the model has dropped abruptly but has yet to cross the signal line (below). But the muted reaction to hot data today in risk markets reflects the optimism increasingly being expressed about a market that "can live with" higher for longer rates. Nominal earnings growth continues to surprise on the upside, backfilling the PE expansion that we saw last year. As I have said before, equity risk premia will drop lower and for longer than you think. The regime change of a more inflation-prone global economy, combined with the under-priced risks to bond yields from excess fiscal stimulus, supports a higher stock over bond allocation strategy, and I think the market knows that.

Copper versus Gold tells us a story of higher growth and higher rates, consistent with the narrative Fed pivot that is getting pushed further out. Until the lower-income cohort of the U.S. economy exhibits pronounced weakness, the Fed will remain on hold. A sufficiently high interest rate level that creates that weakness has yet to be seen. Jerome Powell has been suddenly painted into a monetary corner in this hyper-sensitive election-dominated cycle. His window to have lower rates well in advance of November is closing quickly. Dare he move policy so near to an election?

I don't know if he's Arthur Burns or Paul Volker, but we will find out shortly.

Cu/Au

Comments