Crowded Trades

The herd instinct in financial markets has often been intensely scrutinized for mean reversal trades. Hedge funds frequently use the evidence of overly popular trends to position on the 'short' side of these manias. Sometimes, it works, and sometimes, it doesn't. Irrational behavior can often outlast financial solvency. But this year, contrarianism seems to be working.

The popular trade in 2024's first six months was Mega Cap Tech. Many market commentaries (mine included) decried the market's narrowness and predicted the trend's demise. And then it happened. The narrative around AI peaked and the stocks sold off hard. Then, with the onset of weaker-than-expected inflation data, bonds and bond-like equities - Staples, Banks, and Utilities - sucked up the Tech profit-taking and vaulted markets to new highs on Fed easing expectations. So contrarianism worked if it led you to sell the Magnificent Seven and buy yield.

So, a new crowded trade has quickly formed around a Fed-induced slower-growth economy. Bondies are crowing about their long-duration stances. Dividend clippers are finally happy as competition from money market funds wanes. The widow and orphan trade is finally popular—with good reason.

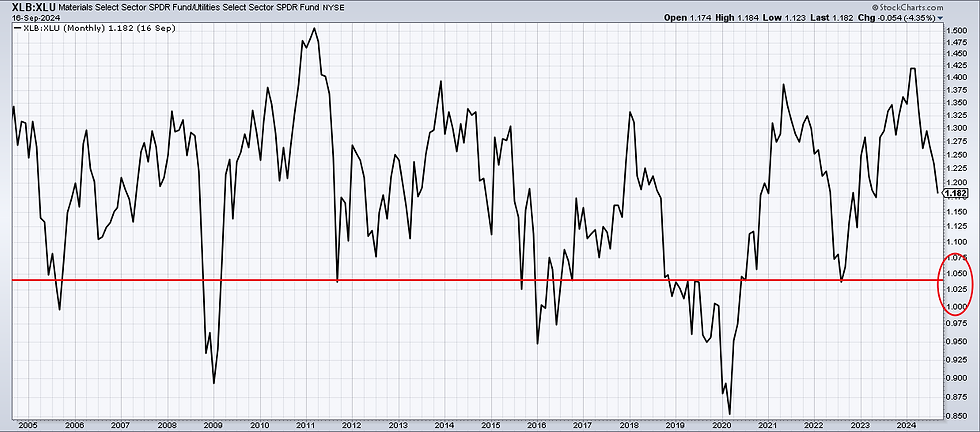

Conversely, commodities have become an area to shun. As domestic China softness weighs on trader sentiment, exposure to commodities as an asset class is at a new low. The copper market has given back all of its spring rally; oil is at a two-year low, and lumber is limping along at the bottom. It seems like a very uncrowded trade to me.

Markets are priced for a nearly 250 basis point easing as tame inflation and softness in employment have coincided since June. But suppose the Fed achieves the soft landing that 80% of investors expect. What next? A brief inflationary reacceleration could soon follow if the Fed cuts too aggressively by lowering rates below 3%. The neutral rate is probably higher than the Fed thinks. That could easily lead them to go too far and 'over ease.'

In that scenario, the new crowded trade in bonds is highly vulnerable. I'm not predicting that scenario with any precision. We still have time to parse the data as we head into the choppy fourth quarter. But as a contrarian, you have to give it at least even odds.

Save some cash for the most uncrowded trade out there - commodities. We are getting close to the 'buy' zone. As the chart shows, it always comes quickly and doesn't last long.

S&P Materials vs. S&P Utilities

Risk Model: 2/5 - Risk Off

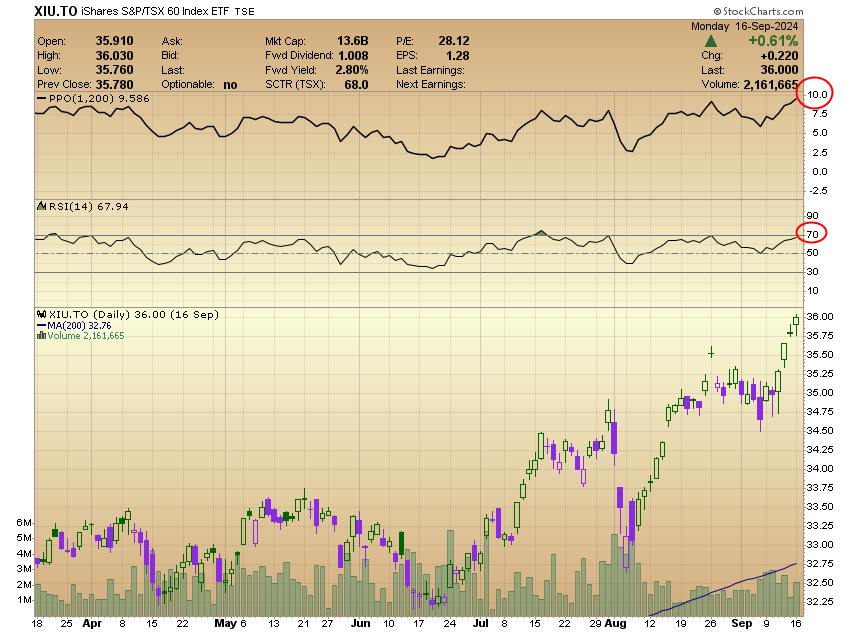

Having played catch-up to those worldwide, the Canadian market is becoming quite overbought. TSX Financials are at an overbought extreme, trading 15% above their 200-day moving average. A risk-off signal is in place with weak Copper/Gold readings, elevated VXV, and a sudden decline in AAII Bull readings. Talk about a sell-on-news if the Fed only lowers 25 basis points tomorrow!

S&P TSX 60

As for Copper/Gold, a base pattern could be shaping up. Fed easing that leads to an inflation rebound and seasonal forces are possible catalysts for bottoming the commodity trade here.

Copper/Gold

Comments