Artificial Economy

This market is destroying any remaining notion that the stock market is equivalent to the economy. Banks are shedding bankers, real estate is really scary, and retailers are turning tail. Commodities are weak, gold is not rallying, and employment prospects are looking weaker. The markets just don't reflect a landing, hard or soft, judging by the lagging cyclical participation. In the meantime, Artificial Intelligence is the sole narrative driving this market higher as the deterioration in the real (old?) economy accelerates. Is it really a bull market if the economy doesn't reflect it?

Yes, but not the one I want to see. I yearn for one that is based on a post-tightening monetary expansion phase with broadening participation from diverse sectors of the global economy. That is nowhere in sight. The bond market has cemented its 'Fed is done' call, and with its Dimon Bottom firmly in place, all that is left is for the long and variable lags of monetary tightening to play out. A hard landing is still possible, but you wouldn't know it by looking at the rising stock market averages. Forget oils, banks, airlines, and Walmart, - NVDA and MSFT to the moon!

Will the 2%+ real yield level still offered by long-dated bonds stop this Fomo-driven re-risking in its tracks? Won't the reversal in bonds actually prevent the Fed from cementing the yield pivot with a flatter curve by lowering rates? And what about the further inversion to the curve that we have seen this past 10 days? Shouldn't that perpetuate the consumer suppression we have been experiencing?

We shall see, but in the meantime, forget all the non-confirmations, there is momentum to chase.

Apple is a case. in point. Their core business has slowed, not least due to the China factor. But the quality of their balance sheet, the wide moat of their product ecosystem, and their return of capital perpetual motion machine means the stock is being rewarded for these attributes with an expanding valuation premium to the market. The same with AMZN, META, and GOOGL.

TSLA has been left behind. Its once venerated, now vilified, owner has jumped headfirst into a self-made ideological dumpster fire stoked by his increasingly paranoid beliefs. His gaslighting and recriminatory legal efforts involving Twitter could present an existential threat to Tesla as a brand. Who knew lighting $46 billion dollars of personal wealth on fire could have repercussions on your reputation? But I digress.

Replacements such as AVGO, NFLX, or BRK-B may suffice, but the Magnificent Seven label is just a convenient sobriquet that reflects the scarcity of growth opportunities in the broader market.

Quality, as a stock factor, is still the leadership. Sadly, there isn't enough to go around. This has generated the 'Magnificent Seven' mania we are now experiencing. However, the lack of diversification offered by the broad averages is of no concern in an investment world dominated by passive flows.

We may be able to blow the 'all clear' on bonds but there is no way to tell if this extends to the economy generally and, by extension, wide swaths of the stock market. This could still end badly should the Fed's intransigence create sudden weakness in the labour market. Post the currently positive seasonality of retail spending, we may just see such a development.

Without a Fed permission slip, there is still a risk of this economy being caught in the hall and being sent to the principal's office. Nothing artificial about that.

Risk Model: 4/5 - Risk On

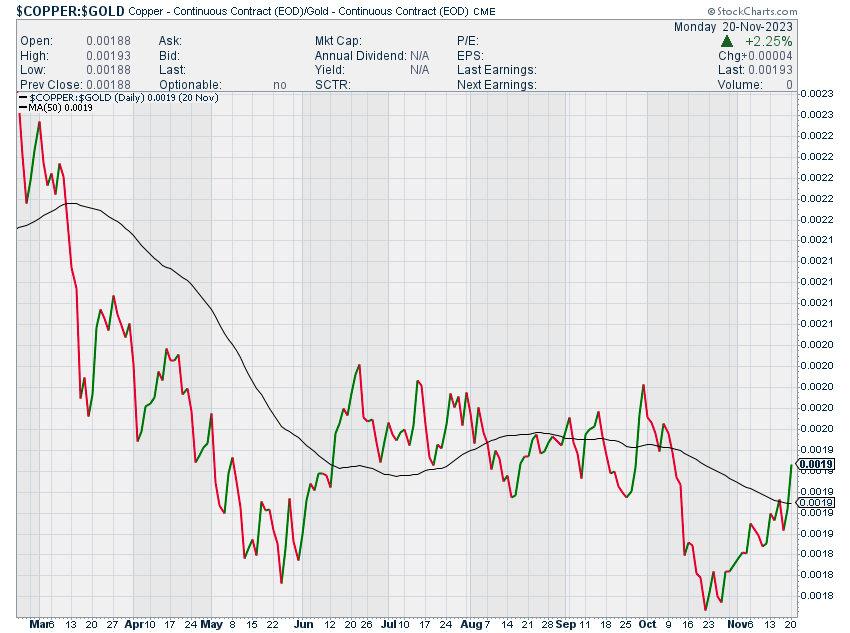

This week has seen the overbought market stay overbought, due to the positive vibe of a docile bond market that in turn supports growth stocks. The sudden burst of optimism in the copper markets is welcome but suspicious at the same time. Is it because of a weak dollar, supply shocks in Panama, or the developer stimulus announcements from Beijing? All three I guess, but it isn't because the economy is about to turn higher in my view. But I will take it. Any support for the 'landing' part of the soft landing scenario is welcome. Watch out for bonds to suddenly lose their short-squeeze-induced bid if this persists.

Perhaps it is the same kind of head-fake we saw in the summer, but it's too early to tell. The Fed is still pinned down by the conflicting nature of this unusual economy. They are still likely to stay glued to the brake pedal for now which tilts the scenario towards a harder outcome that consensus wants to believe. Yes, I still believe in the predictive power of the inverted yield curve, despite the duration of the lag this cycle. The message it is currently giving doesn't support a reversal of equity leadership towards the real economy stocks just yet.

Copper/Gold Ratio

Comments